Want better value?

Go Direct!

Get more with your money

with the Berkshire Direct Bundle

- No incoming wire fees for domestic or international transfers

- Cell phone insurance3

- Free basic wallet-style checks4

- ATM waivers and surcharge rebates5

- No Overdraft Protection Transfer Fees when linked to any Berkshire Bank savings or money market account

Client must enroll. - Identity theft protection6

- MyBanker

Personalized financial planning for all your banking needs. We will come to you.

Banking products are provided by Berkshire Bank: Member FDIC. Equal Housing Lender. Berkshire Bank is a Massachusetts chartered bank.

Checking Disclosure:1 This is a variable rate account, and the rate may change after the account is opened. The Annual Percentage Yield (APY) is accurate as of 6/24/25 and subject to change. Fees may reduce earnings. The minimum balance to open the Berkshire Direct Checking account is $1,000. Available to consumer customers only. To obtain the disclosed Annual Percentage Yield you must maintain one of the following requirements: • A minimum combined monthly direct deposit amount of $7,500.00 in your Berkshire Direct Checking account; OR • An average monthly balance of $50,000.00 in your Berkshire Direct Checking account each monthly statement cycle. Early account closure fee may apply if account is closed within 12 months of account opening. See fee schedule for applicable fees and Truth-in-Savings Disclosure.

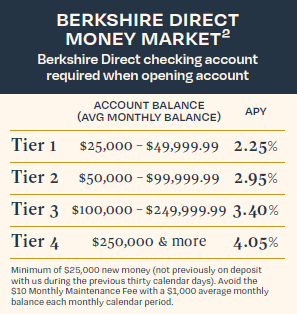

Money Market Disclosure:2 This is a variable rate account, and the rate may change after the account is opened. The Annual Percentage Yield (APY) is accurate as of 6/24/25 and subject to change. Fees may reduce earnings. Minimum balance to open the Berkshire Direct Money Market account is at least $25,000 in new money not already on deposit in other accounts with Berkshire Bank during the previous thirty calendar days. Available to consumer customers only. To qualify for a Berkshire Direct Money Market account, you must be a primary OWNER of a Berkshire Direct Checking account. If you are not the primary OWNER of a Berkshire Direct Checking account, your Berkshire Direct Money Market account will be closed, and the balance will be mailed to you in the form of a Cashier’s Check. Must maintain an average monthly balance of $25,000.00 to obtain the disclosed APY. Interest Rates and Annual Percentage Yields (APYs) rates shown are accurate as of the date listed. The balance tiers for the Berkshire Direct Money Market are as follows: $25,000 – 49,999.99; $50,000 - $99,999.99; $100,000 - $249,999.99; $250,000 or more and reflects the current minimum daily collected balance required to obtain the applicable APY. Rates subject to change without notice. Berkshire Direct Money Market maintenance and other fees, if any, apply and may reduce account earnings. The balance of the Berkshire Direct Money Market account cannot exceed $5,000,000. Early account closure fee may apply if account is closed within 12 months of account opening. See fee schedule for applicable fees and Truth-in-Savings Disclosure.

Cell Phone Disclosure:3 Benefits are subject to terms, conditions, and limitations, including limitations on the amount of coverage. Coverage is provided by New Hampshire Insurance Company, an AIG company. Policy provides secondary coverage only. Cell phone insurance is offered through Mastercard. The maximum liability is $800 per claim, and $1,000 per covered card per 12-month period. Each claim is subject to a $50 deductible. Coverage is limited to two

(2) claims per covered card per 12-month period. See Terms and Conditions for more details.

Basic Checks Disclosure:4 Receive free basic wallet-style checks for your new Berkshire Direct Checking account only. No cash value or credit towards non-basic wallet style checks.

ATM Fees Disclosure:5 All non-Berkshire Bank ATM Inquiry fees waived. We will reimburse all non-Berkshire Bank ATM Withdrawal and Surcharge fees incurred nationwide per statement cycle. Your surcharge (non-Berkshire Bank ATM fee) credits may be reportable to the IRS on Form 1099-MISC. "Statement Cycle” begins the calendar day after the previous Statement Cycle ends and runs through the last business day of the statement period. Berkshire Bank’s ATM policies are subject to change at our discretion at any time.

Identity Theft Disclosure:6 Information about Identity Theft services will be sent in a separate email. Eligible customers for Identity Theft services would include the Consumer, his/her spouse or domestic partner, dependents in the household up to age 25, other IRS-qualified dependents in the household, and parents living at the same address as the consumer, or living in hospice, assisted living, or nursing home.