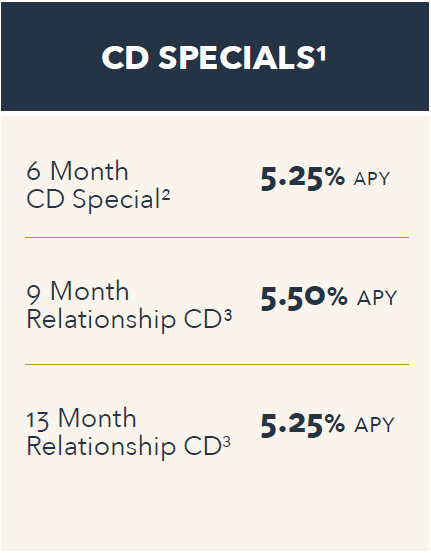

CD Specials Disclosure: ¹The minimum balance to open an account and attain the stated Annual Percentage Yield (APY) is $1,000. APY is accurate as of 10/23/23 and is subject to change at any time. A penalty may be imposed for early withdrawal. Fees may reduce earnings. ²You can open more than one CD, but the total balance combined cannot exceed the $1,000,000 cap. ³In order to qualify for the 9 Month Relationship CD premium interest rate and APY, you need to open the CD entirely with funds that have not been on deposit with Berkshire Bank during the previous 30 calendar days, you must be an OWNER on a Berkshire Bank checking account, and the maximum balance for the certificate account does not exceed $5,000,000. Recurring ACH and direct deposits are not considered new funds. In order to qualify for the 13 Month Relationship CD premium interest rate and APY, you must be an OWNER on a Berkshire Bank checking account, and the maximum balance for the certificate account does not exceed $5,000,000.You can open more than one CD, but the total balance combined cannot exceed the $5,000,000 cap. Transaction limitations are as follows: You may not make any additional deposits into your Relationship CD account before maturity.

Savings Disclosure: 4This is a variable rate account and the rate may change after the account is opened. The Annual Percentage Yields (APYs) are accurate as of 10/23/23 and subject to change. Current APYs are: 4.25% APY Fees may reduce earnings. Minimum balance to open the Excitement Savings account is at least $10,000 in new money not currently on deposit with us. The minimum balance to obtain the disclosed APY is $10. No maintenance service charge fees will be charged on this account regardless of the balance maintained. In order to qualify for this account, you need to open the account with funds that are not already on deposit in other accounts with us and have a

Berkshire Bank checking account with an ownership relationship. The balance of the Excitement Savings account cannot exceed $1,000,000. Early account closure fee may apply if account is closed within 12 months of account opening. See fee schedule for applicable fees and Truth-in-Savings Disclosure.

Money Market Disclosure: 5This account will receive a variable premium interest rate and Annual Percentage Yield (APY) for a period of twelve months from account opening. The variable premium interest rate and APY may change after account opening. After the twelve months the account will convert to our standard Money Market and the interest rate and APY will depend upon the applicable rate tier at that time. The minimum balance to open a Premium Relationship Money Market is $1,000. You can deposit funds from

an existing account to the Premium Relationship Money Market at account opening or thereafter, however, the interest rate and APY is based on the new money initially deposited. Minimum Balance to attain the Premium Relationship Money Market APYs, after the initial new money funding, is $10: First Tier 3.25% APY; Second Tier 4.00% APY; Third Tier 4.50% APY; Fourth Tier 5.00% APY. To qualify for one of the premium rates listed above, you will need to have a Berkshire Bank checking account with an OWNERSHIP relationship. You will also need to open the Premium Relationship Money Market with funds that are not already on deposit in other accounts with Berkshire Bank. Money Market maintenance and other fees, if any, apply and could reduce earnings on this account. The balance of the Premium Relationship Money Market account

cannot exceed $5,000,000. Premium Relationship Money Market rates current as of 10/23/23. Limited Time Offer and may be withdrawn at any time.

.png)