Up to 5.00% APY‡ Lets You Bank Smart.

Premium Perks for Everyday Banking

FDIC Insured, no monthly account fees or minimum balance requirements, PLUS access to real branches and 24/7 U.S.-based support. Unlock the secrets to maximizing your banking experience, with Berkshire One.

Stream On & Get Your Favorite Shows on Us

It’s time your bank did more than just store your cash!

Stream On1 is where we’ll pay up to $15 per month towards your qualified streaming service for two whole years. All you have to do is direct deposit at least $2,000 per month and pay for your streaming service with your Berkshire One checking account†... and say hello to movie nights!

Limited-time new checking promo offer* — good for monthly subscriptions on:

Disney+, Netflix, Hulu, YouTube Premium, or Paramount+

Smart Banking

Save Trees & Earn Cents

Go green! Sign up for paperless statements with your Berkshire One checking† and earn 0.10% interest—because even tiny trees and tiny interest can grow big.

FDIC Insurance

Rest easy knowing your money is secure with FDIC insurance, and we’ve been doing this for nearly 200 years.

Superior Perks

Cell Insurance3

Drop your phone in your soup? We've got you covered. All you have to do is pay your monthly cell phone bill with your Berkshire Bank debit card.

Cash Anywhere

You have access to our extensive network of ATMs. Gone are the days of worrying about ATM fees. Use any ATM, and we'll refund the fees nationwide4. Enjoy unlimited convenience, wherever you are.

Identity Protection5

Get protected with free, best-in-class identity protection services. No need to worry thanks to continuous credit monitoring and fraud expense reimbursement.

Why settle for less?

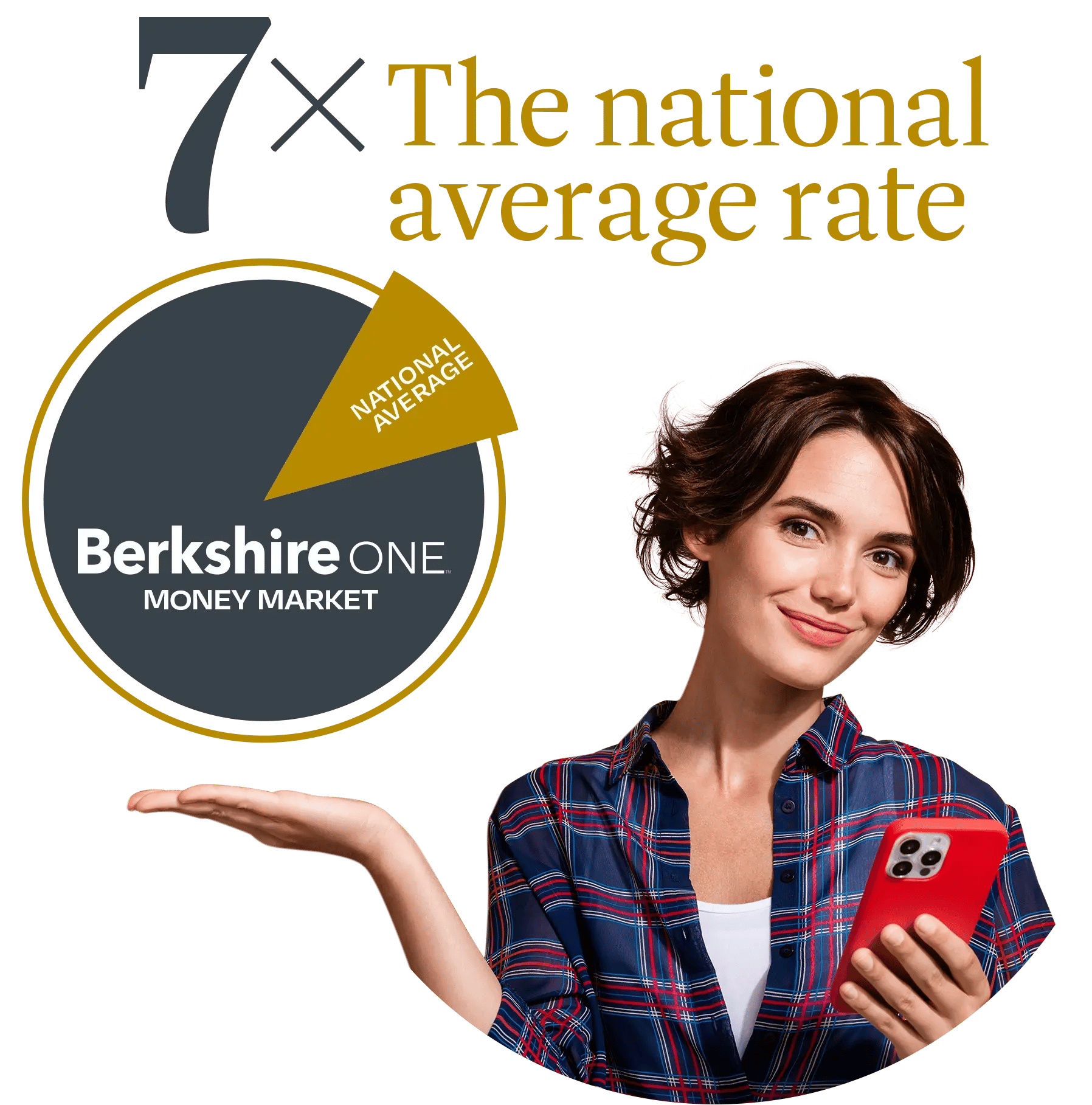

Have you heard the buzz? With money market rates 7x higher6 than the national average, your money works harder with Berkshire One. Bank where your savings skyrocket and your community thrives. Join us and feel the difference—because Where You Bank Matters.TM

Enjoy our best-in-class rates!

5.00% APY with Berkshire One Money Market‡

4.00% APY with Berkshire One Savings**

5.00% APY with Berkshire One 6 Month CD***

Tiny Banking

Say hello to Berkshire One by Berkshire Bank, your all-in-one mobile banking app7 for the palm of your hand! Rated 4.8 stars8, it's designed for busy lives.

| FAST account opening in under 2 minutes | |

| ON THE GO financial budgeting | |

| SEND MONEY to anyone, anytime—platform agnostic. Don’t have Zelle or Venmo? No worries, we’ve got you covered! |

|

| QUICKLY DEPOSIT checks, transfers, and pay bills | |

| MANAGE CARDS and order checks |

Invite Friends to Berkshire One Checking and earn up to $4009 in 3 easy steps:

| Invite Use your email template or share your referral link to let your friends know about Berkshire Bank. | |

| apply Your friends apply for accounts using your referral code. | |

| Receive If their application is approved and qualifying activities are met, you'll each get $1009 in your accounts! |

To Refer a Friend today: Login to Online Banking or Open the Berkshire Bank Mobile App.

Click Here for more details.

We get it.

Banking can be confusing sometimes—but it doesn’t have to be.

Here are a few questions that you might have.

FAQs

Q: Do Berkshire One Checking and Savings accounts have fees? |

Q: How do I withdraw money from my Berkshire One checking account? |

Q: What is the APY on Berkshire One’s checking account? |

Q: Does the checking account come with a savings account? |

Q: How will I get a $15 credit towards streaming? |

Q: Do all Berkshire One accounts qualify for Identity Theft Protection? |

| Absolutely, all Berkshire Bank checking, savings, money market, and certificate of deposit accounts qualify for identity theft protection. | |

Q: How will I earn 4.00% APY on my Berkshire One savings account? |

Q: How will I earn 5.00% APY on my Berkshire One money market account? |

| All you have to do is have an open and active Berkshire One checking account and maintain a minimum of $250 in your Berkshire One savings account to avoid a maintenance fee. | It’s simple, just open and have an active Berkshire One checking account and maintain a minimum balance of $1,000 in your Berkshire One money market account to avoid a maintenance fee. |

Frequently Asked Questions

We get it.

Banking can be confusing sometimes—but it doesn’t have to be. Here are some answers to questions you might have.

How will I benefit from Berkshire One?

Can I walk into a branch to open a Berkshire One account?

Why do I need to sign up for direct deposit?

Setting up direct deposit means we get to spoil you with the best of what Berkshire has to offer. It’s all about convenience with direct deposit.

How do I set up direct deposit?

Will my money be safe with an online bank account?

You bet! All Berkshire accounts come with FDIC insurance up to $250,000 per depositor (customer) per FDIC-Insured bank, per ownership category. We are a real bank, in business for nearly 200 years with over 80 branches in Massachusetts, Connecticut, Vermont, New York, and Rhode Island.

How do I sign up for the cell phone insurance protection offer?

You are automatically eligible to take advantage of the offer by using a Berkshire Bank consumer debit card to pay your cell phone bill from your Berkshire Bank checking account. To learn more about how you qualify for this cell phone insurance3, Click here.

Tell me about Berkshire One’s Stream On offer.

We’ve got your binge watching covered. With our Stream On1 offer, you get a credit up to $15 a month for 24-months for Disney+, Netflix, Hulu, YouTube Premium, or Paramount+ subscriptions when you set up your $2,000 payroll deposit with Berkshire One checking and pay for that streaming service out of your Berkshire One checking account. Promo is valid for 24 months following account opening so hurry to set-up your direct deposit into Berkshire One checking account so you can get most out of the promo offer! Stream On credits may be reportable to the IRS on Form 1099-MISC. Movie nights just got better.

Stream On offer is a limited-time promotional offer. Offer subject to change without notice. Offer valid only for new checking clients. Existing Berkshire Bank checking account clients will not qualify.

Will I earn interest on my Berkshire One checking account?

How do I download the mobile app?

Are my ATM fees reimbursed with the Berkshire One checking account?

What features are included with our Berkshire One accounts?

- Competitive rates

- No monthly maintenance fees

- Easy, no-cost friends and family payments using P2P payment or Friend to Friend Service through online banking and mobile banking7

- Free identity theft protection5 with your Berkshire One checking account†

- Reimbursement for qualifying streaming service with direct deposit requirement of at least $2,000 per month into your Berkshire One checking account†

- Cell phone insurance protection coverage offered for consumer debit card holders3

- Freeze your debit card on-the-go through your mobile app

How does identity theft protection work?

Get protected with access to a free, best-in-class suite of fully-managed identity fraud detection and recovery services through Berkshire One. Simply enroll with our partner and if you ever become a victim, we have your back. No need to worry thanks to continuous credit monitoring, lost document replacement and fraud expense reimbursement.5

How do I Refer a Friend?

To make a referral, the Referrer must be logged in to their online banking profile:

Through the browser: Click on the Refer a Friend Today! tile located under the Net worth graph on the dashboard or click on Tools and select Refer a Friend.

- Click “Send an invite” and your default email browser will pop up to send your personalized link to eligible individuals; or

- Click “or copy your referral link”, open your email browser, compose an email, and send the personalized link to eligible individuals.

Through the app: Click on the Refer a friend tile located at the bottom of the home screen or click on More and select Refer a Friend located under Services.

- Click “Share your code” to send your personalized link to eligible friends and family members via text or email.

Questions?

Get support from real people with Berkshire One because your banking deserves a personal touch.

Please note this email selection is not a secure form of communication. For your protection Berkshire Bank will not provide confidential account information including account numbers, PINs or Online Banking login credentials via this format.

Banking products are provided by Berkshire Bank: Member FDIC. Equal Housing Lender. Berkshire Bank is a Massachusetts chartered bank. Rates are subject to change at any time.

†Berkshire One Checking: The minimum balance to open a Berkshire One Checking Account is $10. Minimum balance to earn variable interest rate and Annual Percentage Yield (APY) is $0.01. In order to receive the stated variable 0.10% Annual Percentage Yield (APY), this account must be enrolled in Paperless Statements and Notices. This is a variable rate account, and the interest rate and APY are subject to change without notice. Product not available for business accounts. Courtesy Pay℠, our discretionary service, is not available for this account. Generally, we will not authorize or pay transactions when you do not have enough money in your account. Fees may be charged by the merchant if your transactions are returned unpaid. For transactions that are pre-authorized by us, we must pay those transactions when they are presented for payment even if your account balance at the time of settlement is not sufficient to cover them. When this happens, you are not charged overdraft fees or continuous overdraft fees. Identity theft protection services are available for this account. Information about Identity Theft services will be sent in a separate email. Fees may reduce earnings on the account.

1The Stream On credit is not valid for Berkshire Bank clients with an existing Berkshire Bank checking account and is limited to new Berkshire One checking account clients only. The following additional terms apply to this account: If you qualify each calendar month, for the 24 months following account opening, we will credit up to $15 per month into your Berkshire One Checking account. Monthly credits will cease the 25th calendar month after account opening. Berkshire Bank will provide a credit in the amount of the highest streaming service paid up to $15. For example: If you pay $6.99 a month for Netflix and $7.99 a month for Disney+, you will receive a streaming service credit of $7.99 the following calendar month. If you pay over $15 a month for one of the below streaming services, you will receive a credit of $15 the following calendar month. This credit will show on your statement with the description “Credit for streaming service”. Stream On credits are capped at 24 per tax reported owner. When the Stream On qualifications are met, the credit will be posted to your account within the following calendar month. If you do not qualify at any point during the 24 calendar months following account opening, you will NOT receive the streaming service credit for that calendar month. Stream On credit Scenarios: 1. You open your Berkshire One Checking account August 1, 2024, and qualify for the Stream On credits consistently for 24 months. At the end of the promotional period, July 31, 2026, you will have received 24 Stream On credits. 2. You open your Berkshire One Checking account August 1, 2024, but do not qualify for the Stream On credits until September 1, 2024. At the end of the promotional period, July 31, 2026, you will have received 23 Stream On credits. 3. You open your Berkshire One Checking account August 1, 2024, and qualify for the Stream On credit for the remainder of 2024. In January 2025, your monthly combined direct deposit falls short of the $2,000 requirement, you will not receive the credit in February. If you then subsequently qualify in February and continue to qualify each calendar month, you will receive the Stream On credit until July 31, 2026. At the end of the promotional period, you will have received 23 Stream On credits. If the account is closed before any credits are posted to your account, the credits will be forfeited. Your credits may be reportable to the IRS on Form 1099-MISC.

To qualify for the Stream On credit, each Calendar Month you must:

Have a combined Direct Deposit total of $2,000 or more each month into your Berkshire One Checking account AND Set up a monthly subscription with one of the following five streaming services to be debited out of your Berkshire One Checking account: Disney+, Netflix, Hulu, YouTube Premium or Paramount+. Annual subscriptions do not qualify. Both required transactions must post and settle to the account during the Calendar Month. Your monthly streaming service debit must post and settle to your account by the end of business (5 PM EST) on the last business day of a Calendar Month to be counted. Transactions may take one or more business days to post and settle to an account after the date a transaction is made. “Calendar Month” begins on the first of the month and ends the last day of the monthly period.

**Berkshire One Savings: This account will receive a variable premium interest rate and Annual Percentage Yield (APY). The variable premium interest rate and APY are subject to change without notice. Fees may reduce earnings. Minimum balance to open the Berkshire One Savings account is $250. The minimum balance to obtain the disclosed APY is $10. In order to qualify for this account, you need to have a Berkshire Bank checking account with an OWNERSHIP relationship.

‡Berkshire One Money Market: This account will receive a variable premium interest rate and Annual Percentage Yield (APY). The variable premium interest rate and APY are subject to change without notice. A $1,000 minimum deposit AND a Berkshire Bank checking account with an ownership relationship required. The minimum balance requirement to earn the APY is $10. Fees may reduce earnings. The balance of the Berkshire One Money Market account cannot exceed $5,000,000.

***Berkshire One 6 Month CD: The minimum balance to open an account and attain the stated Annual Percentage Yield (APY) is $1,000. APY is subject to change at any time. A penalty may be imposed for early withdrawal. Fees may reduce earnings. The balance of the Berkshire One CD account cannot exceed $1,000,000. In order to qualify for the Berkshire One 6 Month CD, you must be an OWNER on a Berkshire Bank checking account. Transaction limitations are as follows: You may not make any additional deposits into your Berkshire One CD account before maturity.

Interest rates are variable and subject to change at any time. These rates are current as of 10/4/2024.

2Annual Percentage Yield (APY).

3Cell phone insurance is offered through Mastercard. Berkshire Bank has a relationship with Mastercard to offer services to its customers. The maximum liability is $800 per claim, and $1,000 per covered card per 12 month period. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per covered card per 12 month period. To learn more about how you qualify for this cell phone insurance, Click here.

4All non-Berkshire Bank ATM Inquiry fees waived. We will reimburse all non-Berkshire Bank ATM Withdrawal and Surcharge fees incurred nationwide per statement cycle. Your surcharge (non-Berkshire Bank ATM fee) credits may be reportable to the IRS on Form 1099-MISC. "Statement Cycle” begins the calendar day after the previous Statement Cycle ends and runs through the last business day of the statement period. Berkshire Bank’s ATM policies are subject to change at our discretion at any time.

5 Identity theft protection services are available for the Berkshire One Checking account. Information about Identity Theft services will be sent in a separate email Eligible customers for Identity Theft services would include the Consumer, his/her spouse or domestic partner, dependents in the household up to age 25, other IRS-qualified dependents in the household, and parents living at the same address as the consumer, or living in hospice, assisted living, or nursing home.

67x based on FDIC National Deposit Rate as of June 17, 2024.

7Consult your mobile carrier for any fees they may charge for Internet usage or receiving texts.

8Based on our Berkshire Bank Mobile Android App rating.

9Refer a Friend: Existing Berkshire Bank customers making a referral ("Referrer") will receive $100 for each eligible individual referred to Berkshire Bank (“Referred Person”) who is a new customer without an existing Berkshire Bank relationship, who utilizes the personalized link provided by the Referrer to open a Berkshire One checking account, successfully submits the application using the referral code by December 31st, 2024, and completes the other requirement specified below. Other Berkshire Bank checking products do not qualify. The initial Referrer may receive up to a maximum of $400 within a calendar year for participating in the Refer a Friend program. “Calendar Year” is a one-year period that begins on January 1st and ends on December 31st. For more details on eligibility and how to make a referral, read our Refer a Friend Disclosure.

*Limited Time Offer and may be withdrawn at any time.

Please see the fee schedule for applicable fees and the Consumer Online Account Truth In Savings for additional information. Our account fee policy is subject to change at any time.